Italy’s populist coalition government poses new threat to eurozone

Ben Chu Economics Editor

After a week of intense wrangling, the leaders of the Five Star Movement and the Lega Nord agree a common programme.

Two Italian, populist, eurosceptic parties have reached an agreement to form a government of the eurozone’s third largest economy, setting up the single currency bloc for a possible new crisis.

March’s national elections in Italy delivered a hung parliament, but also left the virulently anti-immigrant Lega Nord and the radical anti-establishment Five Star Movement as the two parties with the most seats.

After a week of intense wrangling, the leaders of the two parties – which have sharply divergent outlooks in a host of areas – announced on Friday that they had agreed upon a common programme.

“This government contract binds two political forces that are and remain alternative, to respect and achieve what they promised to citizens,” said the Five Star leader Luigi Di Maio.

Both parties ran on electoral platforms that threatened conflict with the eurozone and the EU, in areas ranging from busting national budget deficit rules, to clamping down on immigration to lifting sanctions on Russia.

The two parties will stage informal ballots of their supporters on the programme over the next three days, meaning the coalition could take office early next week.

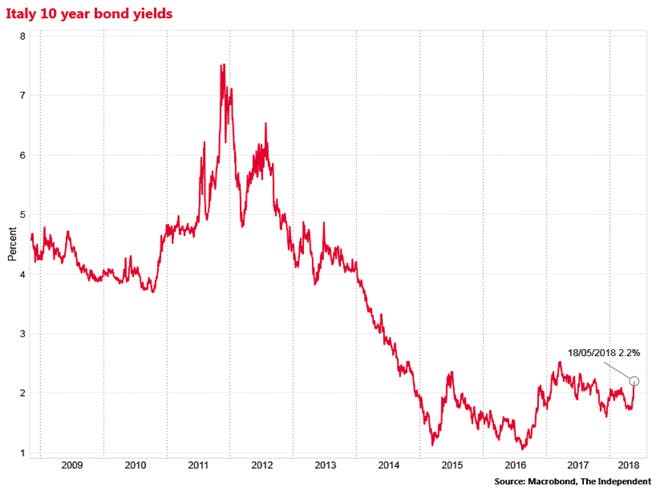

Italian 10-year borrowing costs spiked above 7 per cent in 2011 and 2012, threatening a fiscal crisis for Rome, as traders panicked that the the single currency could be on the verge of splitting apart.

They have since come down dramatically as the European Central Bank has been heavily buying up the country’s sovereign bonds as part of its money printing programme, with the country’s borrowing costs hitting a low of 1.051 per cent in 2016.

On Friday 10-year bond yields, which move in the opposite direction to prices, on Friday rose to 2.2 per cent, the highest since October 2017, although the markets still seem generally unperturbed by the prospect of a Five Star-Lega Nord coalition.

No sign of market panic

The common programme, published online on Friday, promises a universal basic income of €780 per person per month, which it says should be part funded by the EU.

It wants “limited deficit spending” to boost GDP growth and a review of the EU’s fiscal rules.

Sanctions on Russia should be lifted immediately, its says.

In line with the Lega Nord’s anti-immigrant ethos there is a plan to speed up the deportation of 500,000 migrants.

However, there is no mention of a long threatened referendum on EU or eurozone membership for Italy, nor calls for the European Central Bank to cancel the portion of the country’s national debt that it owns (worth around €250bn).

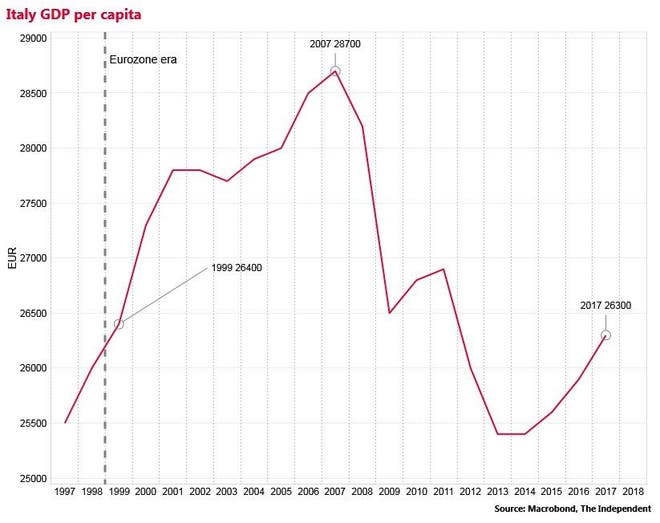

Italy has had one of the worst economic performances in the rich world over the past decade, with its per capita GDP in 2017 still down 8.4 per cent on the level of 2007.

The country’s GDP per capita is even below the level seen when it adopted the euro in 2000.